Marginal tax calculator

0 would also be your average tax rate. At higher incomes many deductions and many credits are phased.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

At higher incomes many deductions and many credits are phased.

. Partner with Aprio to claim valuable RD tax credits with confidence. This is 0 of your total income of 0. Your Federal taxes are estimated at 0.

0 would also be your average tax rate. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Your income puts you in the 10 tax bracket.

000 Marginal tax rate 000 Summary Please enter your income deductions gains dividends and taxes paid to get a summary of your results. 0 would also be your average tax rate. The resultant percentage is called the effective tax rate.

Knowing and understanding your tax bracket can help you to plan for your retirement and how you should invest your hard-earned money. At higher incomes many deductions and many credits are phased. At higher incomes many deductions and many credits are phased.

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. 0 would also be your average tax rate. Your income puts you in the 10 tax bracket.

This is 0 of your total income of 0. At higher incomes many deductions and many credits are phased. These calculations are approximate and.

Your income puts you in the 10 tax bracket. This is 0 of your total income of 0. Your income puts you in the 10 tax.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. This is 0 of your total income of 0. When you divide the tax payable with the taxable income of 63000 and multiply by 100 you get 152.

Your income puts you in the 10 tax bracket. 2020 Marginal Tax Rates Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Your income puts you in the 10 tax bracket.

Calculate the tax savings. This is 0 of your total income of 0. Personal tax calculator.

2021 Marginal Tax Rates Calculator. 0 would also be your average tax rate. 0 would also be your average tax rate.

This is 0 of your total income of 0. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Calculator Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

See How Easy It Is. The marginal tax calculator will help you estimate your. Your income puts you in the 10 tax bracket.

Calculate your combined federal and provincial tax bill in each province and territory. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. This is 0 of your total income of 0.

At higher incomes many deductions and many credits are phased. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 0 would also be your average tax rate.

Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Effective Tax Rate Definition

Marginal Tax Rate Formula Definition Investinganswers

Self Employed Tax Calculator Business Tax Self Employment Self

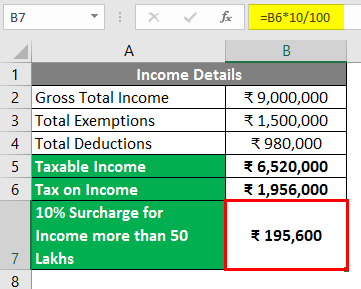

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

California Income Tax Rapidtax

Marginal Tax Rate Bogleheads

Taxable Income Formula Examples How To Calculate Taxable Income

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How To Calculate Federal Income Tax

Calculate Income Tax In Excel How To Calculate Income Tax In Excel